What if your new windows could lower your energy bills and earn you money back? The 2025 new windows tax credit is for homeowners who install energy-efficient windows in their primary residence. Ask your questions, find your answers, and exchange news and tips with specialists from the tech world. The tax credits often cover a … · investing in energy-efficient windows and doors can yield significant financial returns. Update or replace windows energy efficient windows are an important consideration for both new and existing homes. Heat gain and heat … That’s exactly what’s happening for thousands of … If you make home improvements for energy efficiency, you may qualify for an annual tax credit up to $3,200.

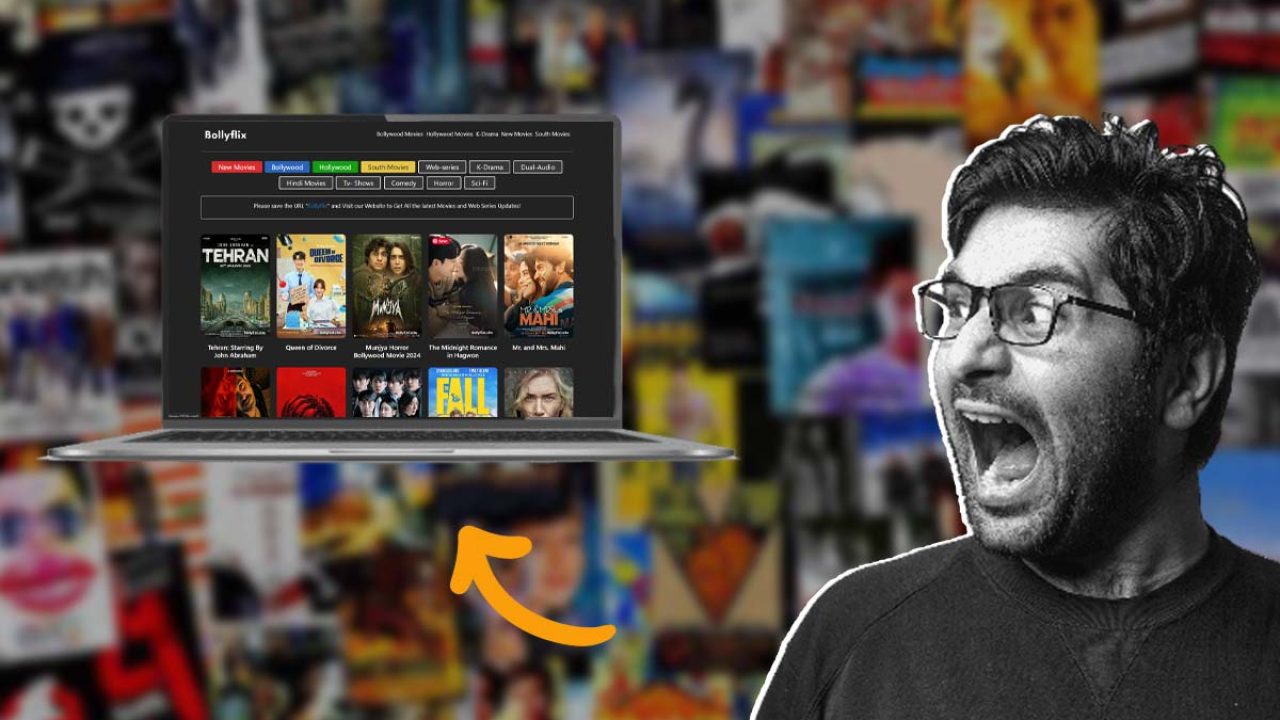

Bollyflix Pk: Bollyflix Pk: Your All Access Pass To Bollywood

What if your new windows could lower your energy bills and earn you money back? The 2025 new windows tax credit is for homeowners who...